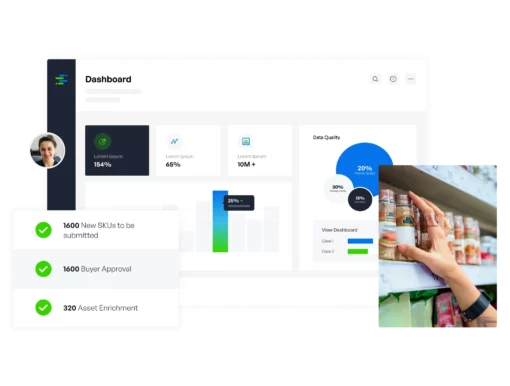

Syndigo is the first cloud-native solution that is purpose-built to deliver exceptional experiences across organizations, domains, and customers.

Internal data governance, effective content delivery, plus performance feedback and optimization, all in one. Regardless of company role, content type, domain, or industry vertical, we’re the only solution needed.

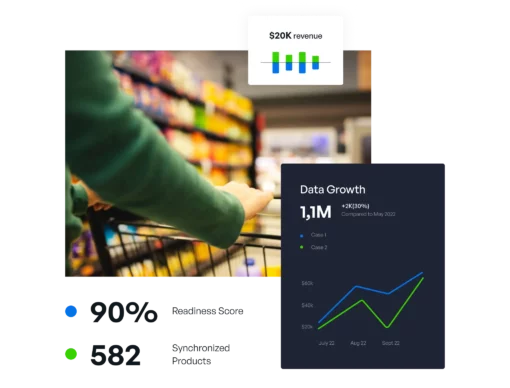

Manage the continual flow of information with a complete solution. Syndigo starts with a leading Master Data Management configuration that connects product, customer, and location domains with the means to scale.

Global Brands And Manufacturers

Global Recipients Connections

Daily Data

Quality Checks

Assets

Published

Retailers & Distributors

Manufacturers & Brands

Foodservice

Automotive Aftermarket

Restaurants & Operators

Healthcare

Consumer Package Goods

Energy

Industrial Manufacturing

Join the Largest, Global Two-sided Network of Brands + Recipients